Changing the UPI pin is easy, and we should do it periodically for added security.

From cash to cards to UPI, money is becoming increasingly digitalized.

UPI (Unified Payments Interface) and its applications are a popular choice of cash transfer via smartphones.

It helps link several bank accounts via a single mobile application and is arguably the simplest method to get paid or pay someone.

As a protection from unauthorized access or transactions, online payments are protected via a PIN, a 4 to 6-digit security code. And it is essential that this PIN remains confidential, i.e., you should not share it with anyone as it will put your bank account at risk.

However, it is best to have it changed immediately if you feel there has been a security breach or if your UPI pin has been compromised.

Here is a quick guide on how you can change your UPI pin in 3 popular UPI applications: Google Pay, PhonePe, and Paytm.

Let’s get started.

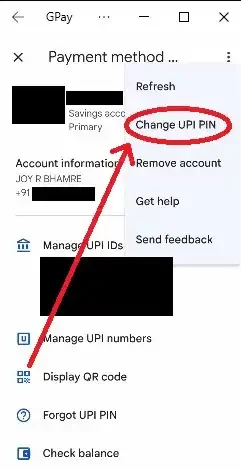

Change UPI Pin in Google Pay (GPay)

Gpay has a relatively simple interface. However, the steps to change your UPI pin are slightly longer. Follow the steps and screenshots below and change your UPI pin effortlessly.

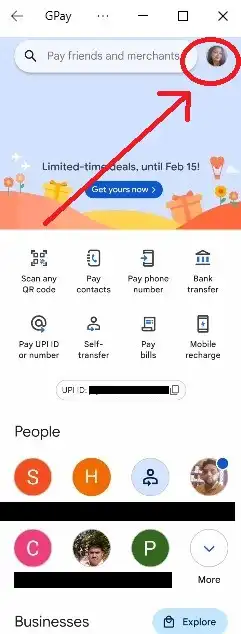

Step 1: Open your Gpay account and click on the user profile icon with your profile picture or initials. This can be found at the top right of your phone’s screen.

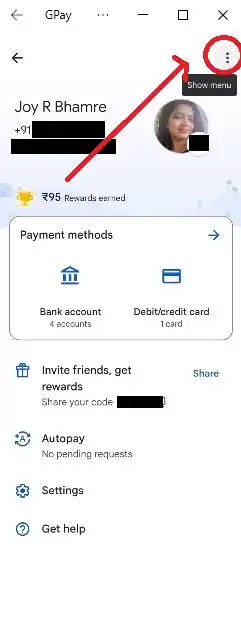

Step 2: Click the three vertical dots on the top right side of your phone’s screen.

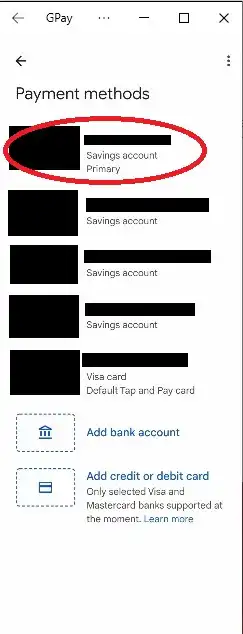

Step 3: From the list of payment methods, choose the bank account that you want to change the UPI pin of.

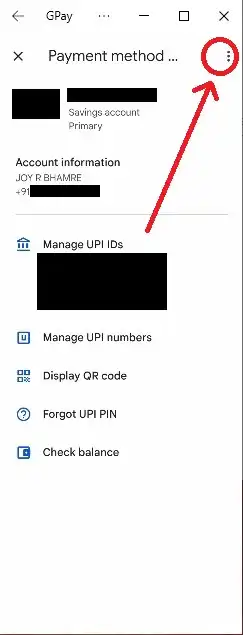

Step 4: Once you have selected the account to which you want to change the UPI pin, you need to click on the 3 vertical dots at the top right again.

Step 5: Now simply choose the Change UPI PIN option from the menu.

Further Steps: Enter Old Pin & Confirm New Pin

Due to security constraints, I could not take additional screenshots. However, the process from here is straightforward.

You just need to enter the present (old) UPI PIN and the new one twice and tap submit.

Once you confirm this, the PIN will change instantly, indicated with a UPI PIN updated pop up.

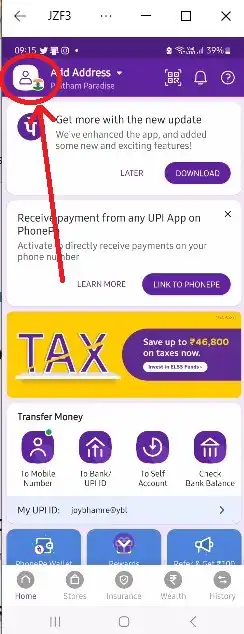

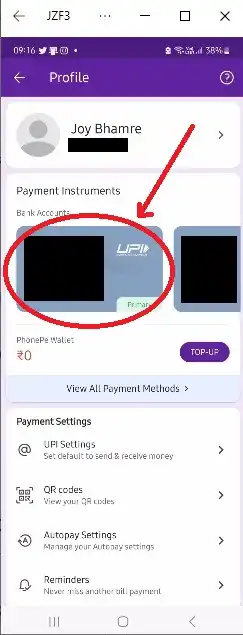

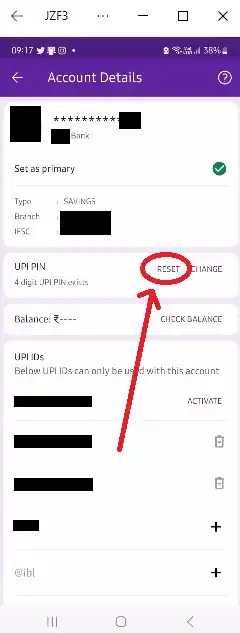

Change UPI Pin in PhonePe

PhonePe’s UPI pin can be changed with fewer steps than Google Pay, but don’t worry, we’ve paid equal attention to detail here, and you have the screen-by-screen instructions below.

Step 1: Open your PhonePe account and click on the user profile icon on the top left of your phone’s screen

Step 2: From the list of payment methods, choose the bank account that you want to change the UPI pin of.

Step 3: Select the RESET option from the UPI Pin option.

Further Steps: These include entering your card details, confirming OTP, entering ATM pin, and finally changing your UPI PIN.

Change UPI Pin in Paytm

Like PhonePe, the Paytm UPI pin changing interface is short and as per the steps below.

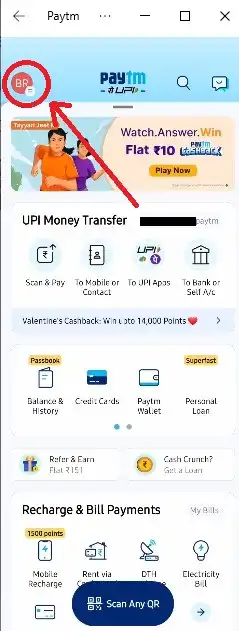

Step 1: Open your PhonePe account and click on the user profile icon on the top left of your phone’s screen.

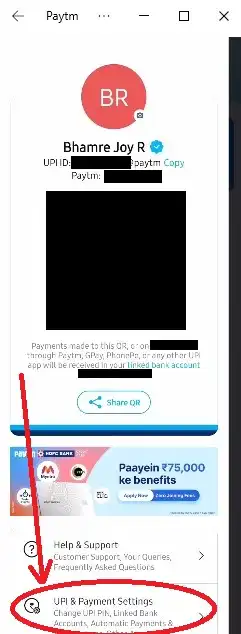

Step 2: Near the bottom of the screen you will see the option UPI & Payment Settings.

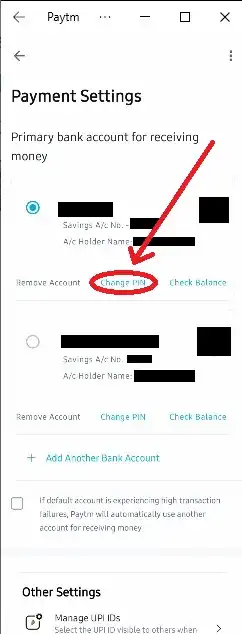

Step 3: Select the bank account you want to change the UPI pin for and click on the Change PIN option displayed in blue (refer screenshot).

Further Steps: The remaining steps are similar to Phonepe, which include, entering your card details, OTP, ATM pin, and finally changing UPI PIN.

Points to Remember

Ensure you type in the correct old PIN as if you enter the wrong PIN 3 times your bank account will get blocked for 24 hours.

While paying through UPI or phone banking is relatively simple and fast, be extremely cautious when making payment.

Confirm the mobile number, QR code, or account details prior to initiating the transaction as once the money leaves your account you will have a lot of trouble re-directing it.

Also, do not be in a hurry to make payments. Take your time to verify things. If haste ever made waste, it will be online payments gone wrong.

Furthermore, once the payment is done, make sure you exit the payment screen and application.

Happy and safe banking to you!